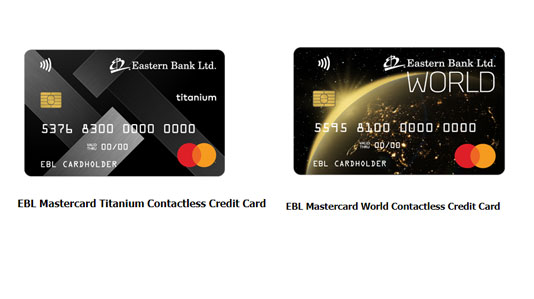

EBL has launched two new Mastercard Contactless Credit Cards, Mastercard Titanium Contactless Credit Card and Mastercard World Credit Card. With the new contactless credit cards, cardholders can simply tap their credit card at designated contactless payment terminals to complete their transactions both home and abroad.

EBL first launched contactless credit cards in 2018. These cards provide a relatively fast and secure mode of payment for customers. In the wake of COVID-19 pandemic, EBL aims to facilitate a secure and hassle-free transaction environment for its customers and contribute to establishing a cashless society in Bangladesh.

Talking about the launch of the contactless credit cards, Ali Reza Iftekhar, Managing Director & CEO of EBL, said, “We put safety and convenience of our customers first and are committed to offer service excellence to them. Offering access to contactless payment both locally and globally in collaboration with Mastercard is a timely initiative to make payments safe for our valued customers during this Coronavirus pandemic.”

Syed Mohammad Kamal, Country Manager, Bangladesh, Mastercard said, “Mastercard is proud to strengthen its continuous collaboration with Eastern Bank limited with the launch of Mastercard Titanium Contactless Credit Card and Mastercard World Contactless Credit Card. At Mastercard, we continuously strive to further drive financial inclusion, offering our valued cardholders broad access to contactless payments both locally and globally. Mastercard has been relentlessly leading the worldwide/nationwide shift to contactless payment for years, pioneering ready-to-go solutions and enabling simple, safe and fast way to pay, to meet the growing needs of cardholders in local and cross-border transactions. In the midst of the COVID-19 Pandemic, WHO (World health Organization) also recommended contactless payment to stop spread of the deadly coronavirus and Mastercard, as a technology company, hopes to bring more such exclusive solutions for the cardholders to make their credit card experiences seamless and safe during this new normal time.”